Financial Forecasting with Machine Learning using Python (Numpy, Pandas, Matplotlib and Scikit-learn)

In this tutorial, we will explore how machine learning can be used for financial forecasting using Python. We will begin by loading financial data from an API and preprocessing it for machine learning, which includes normalization and splitting the data into training and validation sets.

Then, we will define a machine learning model using an LSTM-based neural network architecture and train it on the preprocessed data. After evaluating the model’s performance on the validation set, we will use it to make predictions on new data.

Sounds cool, right?

Alright let’s go!

Step 1. Import the required libraries:

First, you need to import the required libraries, including numpy, pandas, matplotlib, and scikit-learn.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from sklearn.preprocessing import MinMaxScaler

from sklearn.model_selection import train_test_split

from sklearn.metrics import mean_squared_error

from keras.models import Sequential

from keras.layers import Dense, LSTM

Step 2. Load the data:

Next, you need to load the financial data that you will use for forecasting. You can use a financial data API such as Alpha Vantage to load the stock market data for the company of interest.

import requests

api_key = 'YOUR_API_KEY'

symbol = 'AAPL'

url = f'https://www.alphavantage.co/query?function=TIME_SERIES_DAILY_ADJUSTED&symbol={symbol}&outputsize=full&apikey={api_key}'

response = requests.get(url)

data = response.json()

df = pd.DataFrame(data['Time Series (Daily)']).transpose()

df.index = pd.to_datetime(df.index)

df = df.sort_index()

Step 3. Preprocess the data:

Once the data is loaded, you need to preprocess it so that it can be used for training the machine learning model. This involves tasks such as feature engineering, normalization, and splitting the data into training and validation sets.

# Extract the closing prices

y = df['4. close'].values.astype(float)

# Normalize the closing prices

scaler = MinMaxScaler(feature_range=(0, 1))

y = scaler.fit_transform(y.reshape(-1, 1))

# Create the feature matrix

X = []

for i in range(60, len(df)):

X.append(y[i-60:i, 0])

X = np.array(X)

# Split the data into training and validation sets

X_train, X_val, y_train, y_val = train_test_split(X, y[60:], test_size=0.2, shuffle=False)

Step 4. Define the model:

Once the data is preprocessed, you need to define the architecture of the machine learning model. For this example, we will use a recurrent neural network (RNN) with LSTM cells.

# Define the model

model = Sequential()

model.add(LSTM(units=50, return_sequences=True, input_shape=(X_train.shape[1], 1)))

model.add(LSTM(units=50))

model.add(Dense(units=1))

model.compile(optimizer='adam', loss='mean_squared_error')

Step 5. Train the model:

Once the model is defined, you need to train it using the preprocessed dat

# Train the model

model.fit(X_train, y_train, epochs=100, batch_size=32, validation_data=(X_val, y_val))

Step 6. Evaluate the model:

After training the model, you need to evaluate its performance on the validation set.

# Evaluate the model on the validation set

y_pred = model.predict(X_val)

rmse = np.sqrt(mean_squared_error(y_val, y_pred))

print('Root Mean Squared Error:', rmse)

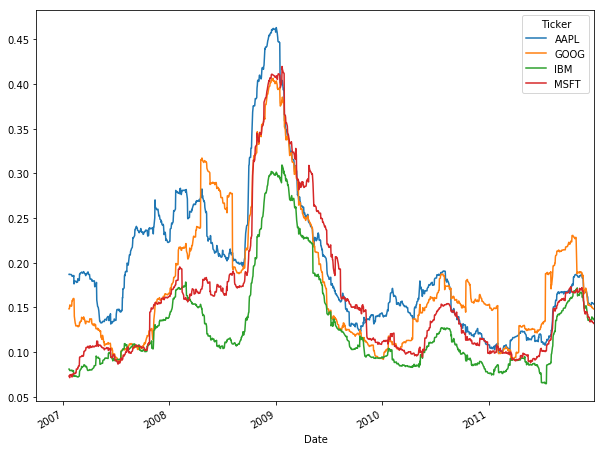

Step 7. Visualize the results:

Once the model is trained and evaluated, you can visualize the results to see how well the model is able to forecast the financial data.

# Visualize the results

y_pred = scaler.inverse_transform(y_pred)

y_val = scaler.inverse_transform(y_val)

plt.plot(y_val, label='Actual')

plt.plot(y_pred, label='Predicted')

plt.legend()

plt.show()

Step 8. Make predictions:

Once you are satisfied with the model’s performance on the validation set, you can use it to make predictions on new data.

# Make predictions

last_60_days = y[-60:]

last_60_days_scaled = scaler.transform(last_60_days.reshape(-1, 1))

X_test = []

X_test.append(last_60_days_scaled)

X_test = np.array(X_test)

X_test = np.reshape(X_test, (X_test.shape[0], X_test.shape[1], 1))

y_pred = model.predict(X_test)

y_pred = scaler.inverse_transform(y_pred)

print('Predicted price:', y_pred[0][0])

This example should give you an idea of how to use machine learning for financial forecasting using Python. With some domain knowledge and creativity, you can use machine learning for a variety of financial forecasting tasks, including predicting stock prices, market trends, and other financial indicators.

If you found this article interesting, then you might find the book: Algorithmic Trading by Lyron Foster a good read.

Lyron Foster is a Hawai’i based African American Author, Musician, Actor, Blogger, Philanthropist and Multinational Serial Tech Entrepreneur.